Oracle 1Z0-1018 Exam Questions

- Oracle Cloud Certifications

- Oracle Enterprise Business Processes (SaaS - ERP) SaaS - ERP Certifications

- Topic 1: Setup Revenue Management And Configure Standalone Pricing/ Manage Contracts And Revenue

- Topic 2: Explain Revenue Principles (Including New Revenue Recognition Guidance Under ASC 606 And IFRS 15)

- Topic 3: Explain Delivered Reports Uses And Processes

- Topic 4: Configure Revenue Management Cloud Services

- Topic 5: Explain Revenue Management Integration Requirements

- Topic 6: Explain How To Create OTBI Reporting Objects

- Topic 7: Placeholder Objective For Another Skill Under Setup And Config

- Topic 8: (NEW For R13) OTBI And Delivered Reports

- Topic 9: Revenue Management Overview

- Topic 10: Standalone Selling Prices

- Topic 11: Revenue Management Setup And Configuration

- Topic 12: Revenue Contracts

Free Oracle 1Z0-1018 Exam Actual Questions

Note: Premium Questions for 1Z0-1018 were last updated On 22-03-2019 (see below)

A corporation uses a primary ledger with a currency of USD. The organization's data includes source document lines with amounts expressed in the Euro currency. However, Revenue Management calculates transaction totals, allocations, and creates accounting in the ledger currency.

What needs to be done in Revenue Management to convert transaction amounts to the USD currency?

You have defined 3 Contract Identification rules: Rule A, Rule B, and Rule C. You then decide that Rule C needs to be the first rule executed when the "Identify Customer Contracts" process runs.

Which attribute needs to be updated to achieve this objective?

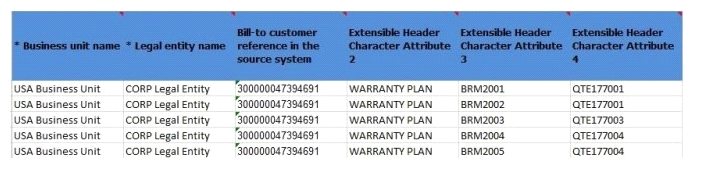

You define a Contract Identification Rule that uses the following source document attributes to match

transaction lines:

Bill-to Customer Party Identifier

Extensible Header Character Attribute 4

Based the data displayed:

How many contracts will be created In Revenue Management?

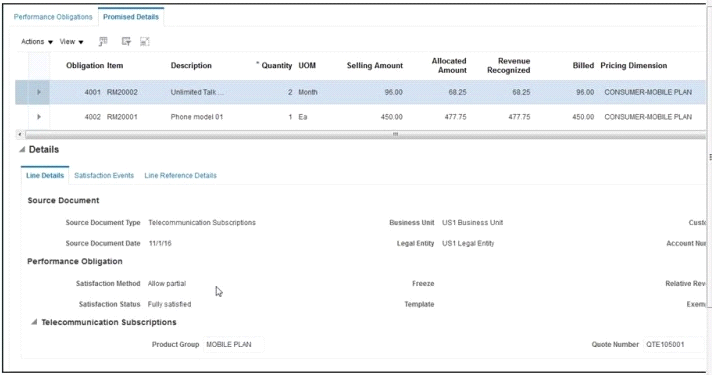

The contract Promised Details tabs includes Selling Amount, Allocated Amount, Revenue Recognized, and Bill.......

What is the difference between Selling Amount and Allocated Amount?

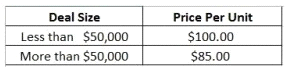

A corporation uses a pricing policy that considers deal size to calculate price per unit for its products. For example:

Which Price Band Segment Label would be appropriate to use in this case?

- Select Question Types you want

- Set your Desired Pass Percentage

- Allocate Time (Hours : Minutes)

- Create Multiple Practice tests with Limited Questions

- Customer Support

Currently there are no comments in this discussion, be the first to comment!